Bvi vs usvi – BVI vs. USVI: A Comparative Analysis of Two Prominent Offshore Jurisdictions. Dive into the legal frameworks, tax implications, business environments, real estate ownership regulations, and economic development strategies of these Caribbean havens.

From the pristine beaches of the British Virgin Islands to the vibrant culture of the US Virgin Islands, these two destinations offer distinct advantages for businesses, investors, and individuals seeking offshore solutions.

Jurisdiction and Legal Frameworks: Bvi Vs Usvi

The British Virgin Islands (BVI) and the United States Virgin Islands (USVI) are two distinct jurisdictions with different legal systems. BVI is a British Overseas Territory, while USVI is a territory of the United States. As such, the legal systems in these two jurisdictions are based on different legal traditions.The BVI legal system is based on English common law, while the USVI legal system is based on US federal law.

This means that the laws of BVI are largely derived from English common law, while the laws of USVI are largely derived from US federal statutes and regulations.The following table compares the key legal frameworks and regulations in BVI and USVI:| Feature | BVI | USVI ||—|—|—|| Legal system | English common law | US federal law || Primary source of law | English common law and BVI statutes | US federal statutes and regulations || Court system | Supreme Court of the Eastern Caribbean | US District Court for the Virgin Islands || Official language | English | English |

Tax and Financial Considerations

The British Virgin Islands (BVI) and the US Virgin Islands (USVI) offer distinct tax rates and financial regulations, catering to different investment and business needs. Understanding these differences is crucial for making informed decisions when selecting a jurisdiction for your operations.

Both jurisdictions have implemented measures to attract foreign investment and support economic growth. However, their approaches vary, with the BVI focusing on low tax rates and the USVI offering tax incentives and a more regulated financial environment.

Explore the different advantages of cafe matisse menu that can change the way you view this issue.

Tax Rates and Incentives

- BVI:BVI companies enjoy a zero percent corporate income tax rate, no capital gains tax, and no withholding tax on dividends or interest payments. This makes the BVI an attractive destination for holding companies, investment funds, and international businesses seeking tax efficiency.

- USVI:USVI companies are subject to a 6% corporate income tax rate, which is lower than the US federal rate of 21%. Additionally, the USVI offers tax incentives for certain industries, such as tourism, manufacturing, and renewable energy. These incentives include tax credits, deductions, and exemptions.

Do not overlook explore the latest data about sarasota sands resort lido key.

Financial Regulations and Reporting Requirements, Bvi vs usvi

Both BVI and USVI have established financial regulatory frameworks to ensure transparency and protect investors. However, the level of regulation and reporting requirements differs between the two jurisdictions.

- BVI:The BVI has a relatively flexible regulatory environment, with minimal reporting requirements for companies. Companies are required to file an annual return with the Registrar of Corporate Affairs, but there are no specific audit or financial reporting obligations.

- USVI:The USVI has a more stringent regulatory framework, with more extensive reporting requirements for companies. Companies are required to file annual financial statements with the USVI Bureau of Internal Revenue and undergo regular audits. The USVI also has specific regulations for certain industries, such as banking and insurance.

Business Environment and Infrastructure

The business environment in both the BVI and USVI is generally favorable, with a skilled workforce, supportive infrastructure, and a legal framework that encourages investment. However, there are some key differences between the two jurisdictions.

The BVI has a more flexible regulatory environment than the USVI, which makes it easier for businesses to establish and operate. The BVI also has a lower cost of living than the USVI, which can be a significant advantage for businesses.

Workforce Availability

Both the BVI and USVI have a skilled and experienced workforce. However, the BVI has a larger pool of skilled workers than the USVI, due to its proximity to the US mainland.

Infrastructure

The BVI and USVI both have well-developed infrastructure, including reliable transportation, telecommunications, and utilities. However, the BVI has a more extensive network of roads and airports than the USVI, which makes it easier to transport goods and people.

Obtain recommendations related to maui vista kihei vacation rentals that can assist you today.

Tourism and Economic Development

The tourism industry is a vital part of the economies of both the BVI and USVI. The BVI is known for its beautiful beaches, crystal-clear waters, and world-class sailing and diving. The USVI is also known for its beaches, as well as its historical sites and cultural attractions.

In recent years, the tourism industry in the BVI has been growing rapidly. The number of visitors to the BVI increased by 10% in 2019, and the BVI Tourist Board expects this growth to continue in the coming years. The USVI has also seen a growth in tourism in recent years, but the growth has been more modest than in the BVI.

Key Attractions

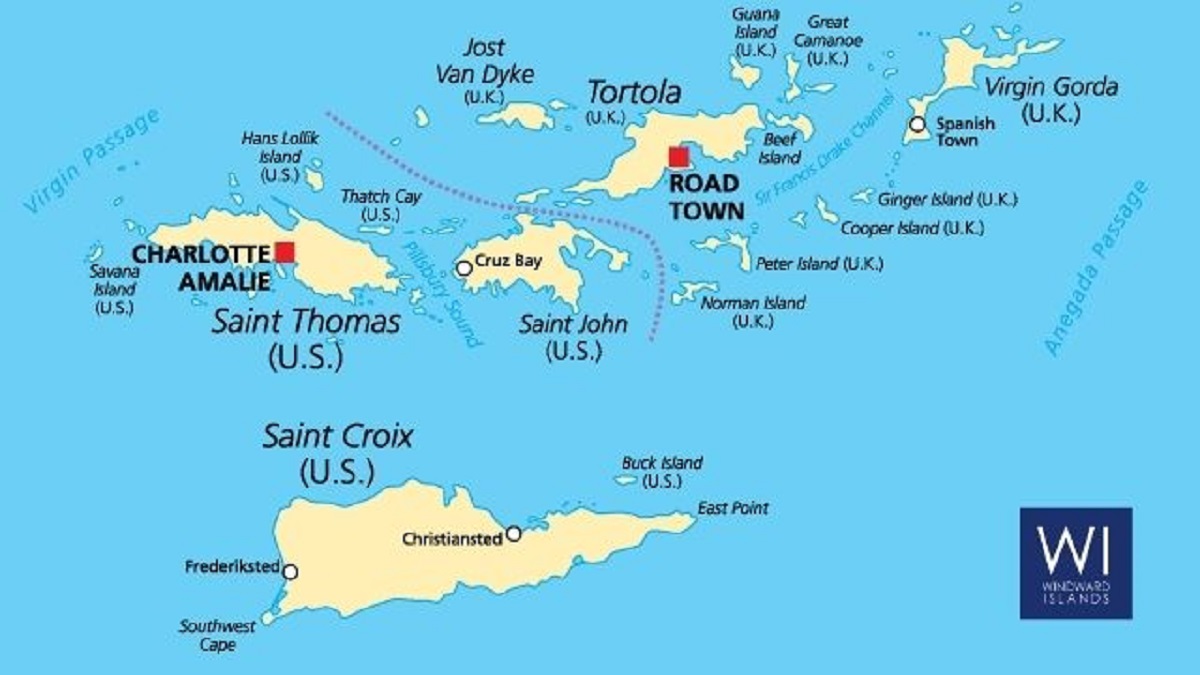

The key attractions in the BVI include:

- The Baths: A series of granite boulders that form natural pools and caves.

- Virgin Gorda: An island known for its beautiful beaches and The Baths.

- Jost Van Dyke: An island known for its laid-back atmosphere and beautiful beaches.

- Tortola: The largest island in the BVI, known for its lush vegetation and beautiful beaches.

The key attractions in the USVI include:

- St. Thomas: The largest island in the USVI, known for its beautiful beaches, historical sites, and cultural attractions.

- St. Croix: The largest island in the USVI, known for its beautiful beaches, historical sites, and cultural attractions.

- St. John: An island known for its beautiful beaches and national park.

Infrastructure

The BVI and USVI have both invested heavily in tourism infrastructure in recent years. The BVI has built a new airport on Virgin Gorda, and the USVI has built a new cruise ship terminal on St. Thomas. Both jurisdictions have also made significant investments in road infrastructure and other tourism-related infrastructure.

Investment Opportunities

There are a number of investment opportunities in the tourism industry in the BVI and USVI. These opportunities include:

- Hotels and resorts

- Restaurants and bars

- Tour operators

- Activity providers

- Real estate

Economic Development Strategies

The BVI and USVI have both adopted different economic development strategies. The BVI has focused on developing its tourism industry, while the USVI has focused on diversifying its economy. The BVI’s strategy has been more successful in recent years, as the tourism industry has grown rapidly.

The USVI’s strategy has been less successful, as the economy has not diversified as much as expected.

Obtain direct knowledge about the efficiency of monte rio beach through case studies.

Growth Potential

The tourism industry in the BVI and USVI has significant growth potential. The BVI is expected to continue to see strong growth in tourism in the coming years, as the number of visitors to the BVI continues to increase. The USVI is also expected to see growth in tourism, but the growth is likely to be more modest than in the BVI.

Last Word

Whether you’re considering establishing a business, investing in real estate, or seeking a favorable tax regime, understanding the nuances between BVI and USVI is crucial. This comprehensive guide provides a roadmap to navigate the legal, financial, and business landscapes of these offshore jurisdictions, empowering you to make informed decisions and optimize your offshore strategy.

Questions and Answers

What are the key differences between the legal systems of BVI and USVI?

BVI follows English common law, while USVI operates under a modified version of the US legal system, incorporating elements of both common law and civil law.

How do the tax rates compare between BVI and USVI?

BVI offers a zero corporate tax rate, while USVI has a corporate tax rate of 6%.

Which jurisdiction provides a more favorable business environment?

Both BVI and USVI offer ease of doing business, but BVI has a slightly more streamlined regulatory framework and a larger pool of experienced professionals.