Navigating the world of business taxation can be a daunting task, but understanding the Palm Beach County Business Tax Receipt is a crucial step towards ensuring your business operations run smoothly. This comprehensive guide will provide you with all the essential information you need to obtain, renew, and maintain your business tax receipt, empowering you to operate your business with confidence and compliance.

Obtaining a Palm Beach County Business Tax Receipt is not just a legal requirement but also a gateway to a range of benefits that can enhance your business operations. From establishing credibility to accessing certain business opportunities, a business tax receipt is a valuable asset for any entrepreneur.

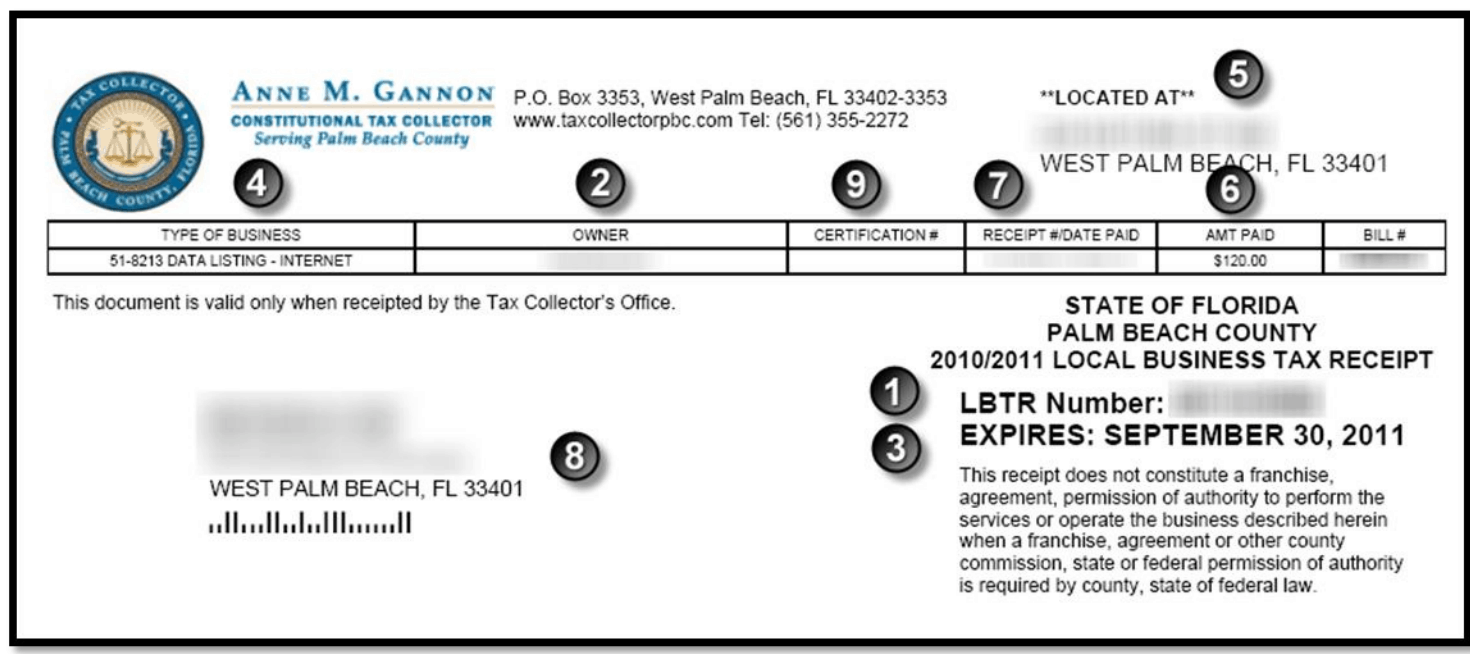

Palm Beach County Business Tax Receipt Overview

In Palm Beach County, every business with a physical presence or doing business within the county must obtain a Business Tax Receipt (BTR). It’s a crucial document that verifies your business’s legitimacy and compliance with local regulations.

The BTR is not just a legal requirement; it also provides several benefits to businesses. Let’s dive into the details.

Who Needs a Palm Beach County Business Tax Receipt?

- Any person or entity conducting business in Palm Beach County, regardless of their location or business structure.

- Businesses that have a physical presence in the county, even if their main office is elsewhere.

- Businesses that conduct business in the county, even if they don’t have a physical presence.

How to Obtain a Palm Beach County Business Tax Receipt

Getting a BTR is a straightforward process:

- Visit the Palm Beach County Tax Collector’s website.

- Complete the online application form.

- Submit the required documents, such as your business license and proof of insurance.

- Pay the applicable fees.

Once your application is approved, you’ll receive your BTR via mail.

Benefits of Obtaining a Palm Beach County Business Tax Receipt

Having a BTR comes with a range of advantages for businesses:

- Legal compliance:It demonstrates that your business is operating legally and meeting its tax obligations.

- Enhanced credibility:A BTR shows potential customers and partners that your business is legitimate and trustworthy.

- Access to county resources:Some county programs and services are only available to businesses with a valid BTR.

- Simplified tax filing:The BTR simplifies the process of filing your business taxes.

Businesses that have obtained a BTR have reported experiencing positive outcomes, such as increased customer trust and access to new opportunities.

Penalties for Operating Without a Palm Beach County Business Tax Receipt

Operating a business without a valid BTR is a serious offense that can result in:

- Fines:Businesses can face significant fines for operating without a BTR.

- Late fees:Businesses that fail to obtain a BTR on time may be charged late fees.

- Suspension or revocation of business license:In severe cases, the county may suspend or revoke your business license.

To avoid these penalties, it’s crucial to obtain your BTR promptly and keep it up to date.

Renewal and Maintenance of a Palm Beach County Business Tax Receipt

Your BTR is valid for one year. To maintain its validity, you must renew it annually.

For residents of Virginia Beach, managing household waste can be a hassle. However, the city’s bulk pickup program makes it easy to dispose of bulky items like furniture, appliances, and yard waste. Simply schedule a pickup online or by phone, and the city will haul away your unwanted items for free.

This convenient service helps keep Virginia Beach clean and clutter-free.

The renewal process is similar to the initial application process:

- Visit the Palm Beach County Tax Collector’s website.

- Complete the online renewal form.

- Submit the required documents, such as your current BTR and proof of insurance.

- Pay the applicable fees.

Renewing your BTR on time ensures that your business remains in compliance and avoids penalties.

Resources and Support for Palm Beach County Business Tax Receipts

The Palm Beach County Tax Collector’s Office provides a range of resources to assist businesses with BTRs:

- Website:The website offers detailed information on BTRs, including eligibility requirements, application process, and renewal procedures.

- Customer service:The Tax Collector’s Office has a dedicated customer service team to answer your questions and provide guidance.

- Educational materials:The office provides educational materials, such as brochures and webinars, to help businesses understand their BTR obligations.

These resources ensure that businesses have the support they need to comply with BTR regulations.

Conclusion

Remember, operating a business without a valid Palm Beach County Business Tax Receipt can lead to costly penalties and legal consequences. By following the steps Artikeld in this guide and utilizing the resources available, you can ensure that your business remains compliant and benefits from the advantages of having a business tax receipt.

Embrace the responsibility of business ownership and take the necessary steps to secure your business’s success.

Helpful Answers

What is the purpose of a Palm Beach County Business Tax Receipt?

A Palm Beach County Business Tax Receipt serves as proof that your business has registered with the county and is authorized to operate legally. It also allows you to collect sales tax from customers.

Who is required to obtain a Palm Beach County Business Tax Receipt?

Any person or entity conducting business in Palm Beach County, including sole proprietorships, partnerships, LLCs, and corporations, must obtain a business tax receipt.

How do I obtain a Palm Beach County Business Tax Receipt?

You can apply for a business tax receipt online through the Palm Beach County Tax Collector’s website or in person at their office.

What are the benefits of having a Palm Beach County Business Tax Receipt?

Having a business tax receipt allows you to operate your business legally, collect sales tax, and access certain business opportunities.

Nestled amidst the tranquil shores of Vero Beach, Florida, Riomar Country Club offers an exclusive haven for golf enthusiasts and nature lovers alike. With its championship golf course designed by the legendary Rees Jones, Riomar promises an unforgettable golfing experience.

Beyond the greens, residents enjoy access to private beaches, a state-of-the-art fitness center, and an array of social activities.

What are the penalties for operating without a Palm Beach County Business Tax Receipt?

Operating without a valid business tax receipt can result in fines, fees, and other legal actions.